The debate over trading forex news is something that has been around for a while, and now a days it gets a bit more attention. Many say that the markets reaction to economic data has become unpredictable and therefore you should avoid it all together. Those on the other side of the argument suggest that news releases offer some of the largest moves in the forex market, and because of this retail forex traders should learn how to trade it. As with any form of trading it is important to look at it from Smart Money’s (SM) perspective. Doing this will give us better insight into two specific questions. First, should we even attempt to trade economic data? If the answer to that question is yes then the next logical question is what trading strategy should we be using?

Again, as mentioned previously it is absolutely essential that we look at this from the banks/SM perspective. They are after all the driving force in every market including forex. Therefore like normal day to day moves, if we can identify what SM is doing during news or how they benefit from a certain move during news then we can identify the next direction of the market with a high degree of accuracy. Doing so is much more simple and straight forward than one might think. The key is to stick to the facts and follow the money. At the end of the day it all boils down to the basic fact that for every buyer there is a seller and for every seller there is a buyer. This is a concept everyone knows and no one applies. Keeping this basic fact in mind lets move on to some charts to illustrate the point.

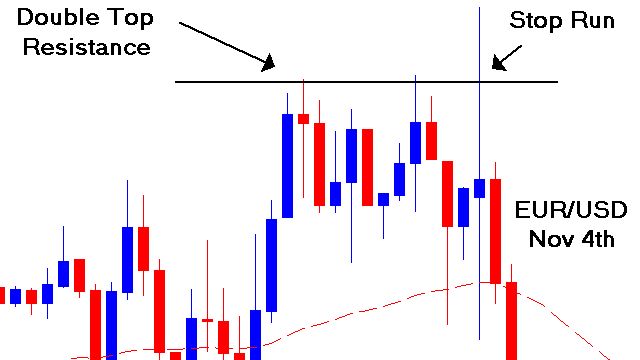

In this chart example and the others we are going to be looking at different Non-Farm Payroll (NFP) releases. This piece of data is well known and respected for the very large moves it can create when there is a sizable enough deviation from the expected number. If you are going to trade economic data it is important that you trade only the major news events. Selecting small news items that rarely if even move the market are much harder to profit from.

Where Are The Orders?

It is a well known fact that SM manipulates the price. Retail traders overall tend to repeat the same mistakes and thus why the percentage of losing traders is so high. Because of this SM understand how to manipulate the price in and around news for their benefit. Remember what we discussed earlier. For every buyer there is a seller and for every seller there is a buyer. For the average retail trader liquidity is never an issue, and thus why so many neglect this basic market fact. For the banks however it is something they must deal with everyday. Because they need massive amounts of buyers if they want to sell, they must create buying pressure in order to fill their short position. Remember you cannot sell unless someone is buying it from you. How can we use this basic fact to our advantage.

The first thing we should do before any major news release we are looking to trade, is to simply identify the nearest high and low that is clear. Why? Let’s use the example in the chart above. You will notice in that chart a clear high that was established before NFP was released. The average retail trader is generally thinking one of two things around a typical short term high in the forex market. One traditional form of thought would say, “there is a clear double top, I’m going short”. Those traders taking this type of short would have their stop loss above the previous high. The second type of trader around this resistance point would be breakout traders looking to take a long on a break of the double tops high. Therefore if that high is broken those that were short expecting the double top to hold would be stopped out, and thus have to buy their short position back. Additionally if that high was broken anyone that placed a breakout trade to go long above the high would be triggered in long. Both types of traders would be triggering buy orders if that high is pierced. Because SM knows there is a mass of retail buy orders above any resistance point, they intentionally spike the price past the resistance so they can sell into the guaranteed pool of buy orders.

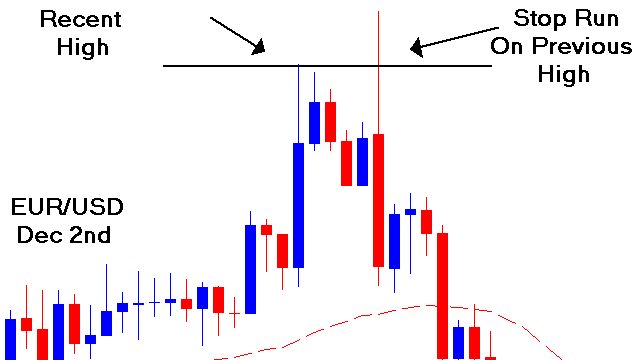

Notice the same pattern again the following month of December. The market has a clear set high before NFP. If that high is broken there will be a mass of buy orders triggered (buying on the breakout & short traders stop loss orders being triggered). They spike the price beyond the high and sell into all the pending buy orders thus driving the price back down very quickly. Again it is important to remember that they must have buyers if they want to sell, and they must have someone willing to sell to them when they are taking a long position. Without the opposite side of the trade no one can enter or exit a position.

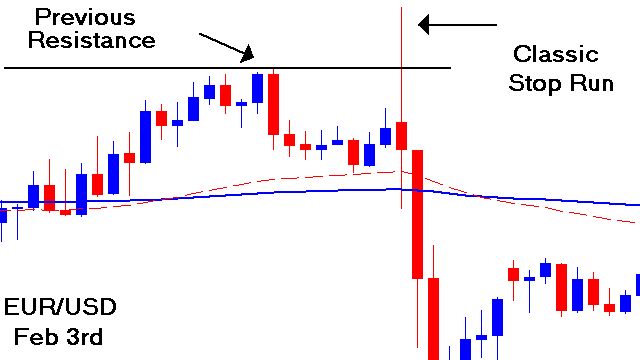

February when we came in for NFP we covered essentially what we have discussed in this article. As Non-Farm was released the price again spiked past the high but I was about 5 seconds to late on this one and the price retraced on us. With that being said there are quite a few other forex news releases every given month that respond this way, but NFP is still king of stop run reversals.

Should You Trade Forex News?

So, should you trade forex news? Traditional forex news trading strategies will over time fail. This has been my experience, and I’m sure most reading this have probably felt the same way. Five or six years ago the news and ensuing reaction in the forex market was much more straight forward. The price would spike in the direction of the news, make a 50-61.8% retracement of the initial spike, and then continue in the direction of the fundamentals. That being said, things are not that simple anymore. So how can you profit from the news if you choose to trade it?

1.) Identify a clear low and high around the price before the news.

2.) As the news is released wait for the market to spike through that high or low and then get rejected back the opposite direction. This rejection will clearly show that SM manipulated the price beyond the high or low to trigger orders.

3.) Preferably that 15M news candle will close as a shooting star or hammer formation. Sometimes it will close beyond the high or low and the next candle does the retracing, which thus forms what is traditionally called railroad tracks.

READY TO START EARNING WITH OUR SIGNALS? CLICK ON GET INSTANT ACCESS BELOW

OUR FX PIPS VIP SIGNALS WEBSITE IS:

FREE 7 DAYS TRIAL!!