- The smart money concept in forex trading involves understanding the behavior of institutional players, such as banks and hedge funds, and analyzing supply and demand dynamics, order blocks, and price patterns.

- SMC is often seen as a repackaged version of price action trading with a long history of producing positive results in various asset classes.

- Skeptics argue that the liquidity contributed by retail traders is relatively insignificant in the eyes of institutional market makers, making it unlikely that they would specifically target retail traders.

- The choice to use SMC trading ultimately depends on individual preferences and the trader’s ability to understand its theory and apply it to the chart.

The Smart Money Concept strategy has gained viral attention over the past few years, and it’s mostly for good reasons: it seems to be working. At least for some people. But what’s unique about this SMC strategy, anyway?

To be accurate, the SMC is not a strategy, per se. But it’s more of a theory or philosophy.

Now, you are probably curious about this new concept. So, here, we reveal everything you need to know about the Smart Money Concept (SMC) strategy. Or theory? Philosophy? Anyway, let’s start

What is the Smart Money Concept in Trading?

So, what exactly is Smart Money concerned with? Simply put, it’s all about supply, demand, and market structure. Market makers, or the “smart money,” often leave footprints of their trading decisions on the chart, and smart money concept traders are to follow these footprints.

Retail traders tend to believe the market is fair for them to make money, but the SMC might prove otherwise. Here’s how the theory goes:

Market makers such as banks, hedge funds, and other prominent market participants who can move substantial amounts of capital can allegedly manipulate the market against retail traders. While this may sound like a conspiracy theory, it is worth looking into.

These institutions are in the business of making profits or supplying the needs of a country or a big corporation. They are not shy about using their vast resources and market knowledge to their advantage, including setting traps for retail traders to part with their money.

Retail traders, often ignorant of these activities, are more likely to fall victim to the market’s unpredictable swings.

However, that’s not the entire idea of SMC. Very often, these big players enter the market with good intentions. For instance, a government that must purchase large quantities of a commodity, such as wheat, soybeans, or crude oil, can obviously push prices in a specific direction.

So, based on the SMC theory, financial markets are largely controlled by financial institutions, hedge funds, and governments. They significantly impact price movements in the market, and therefore, retail traders must be alert to their intentions to predict where the market is heading.

That, in a nutshell, is what the SMC is all about. If you believe in smart money concepts trading, then you, as an individual trader, should follow smart money.

SMC Key Concepts

Rather than being just a theory, SMC is a complete trading methodology with its unique terminologies and concepts. Let’s take a closer look at some of SMC’s concepts and trading techniques.

Order Blocks (OB)

This concept is fundamental to understanding SMC. Essentially, order blocks refer to a market condition when central banks, governments, and large financial institutions accumulate or distribute large quantities of an asset through several big orders. They do so to be able to purchase the asset without creating panic and high volatility in the market.

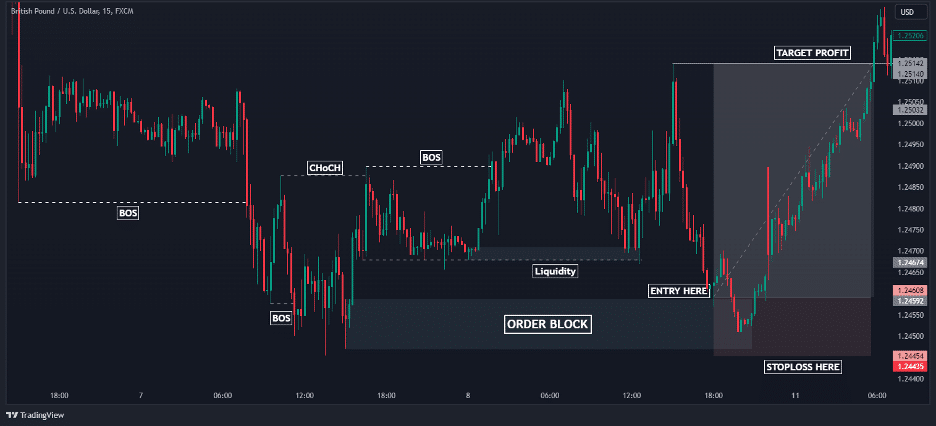

On a price chart, order blocks typically appear as a ranging market (as seen in the chart below). However, to properly identify order blocks in the market, you must use additional tools, such as level 2 market data and volume indicators.

To learn more about order blocks, visit our full order blocks trading strategy guide.

Breaker Blocks

These are order blocks that fail to hold the price level in a given trend. They represent price levels where market makers intentionally break through support or resistance levels to trigger stop-loss orders from retail traders.

On a trading chart, breaker blocks appear as levels where the price breaks above or below a certain level. Based on the SMC theory, most smart money orders are placed at this level.

Fair Value Gaps (FVG)

Fair value gaps, also referred to as FVGs, are a unique trading concept that occurs when the market moves quickly from one price level to another, often leaving gaps on price charts. SMC traders pay close attention to these gaps as they can indicate significant shifts in market sentiment.

Break of Structure (BOS)

The break of structure is a concept that focuses on identifying shifts in the market’s overall trend. A break of structure is said to have taken place when the price sets a new high or a new low while breaking the former ones.

Change of Character (Choch)

Change of Character, often abbreviated as Choch, refers to a situation where the market’s behavior shifts abruptly. It is a sudden change in volatility, volume, or price action, suggesting a weakness in the current trend and a possible reversal.

Liquidity

Liquidity is a crucial factor in SMC trading. It is a point in the price of an asset where orders are either sitting above or below, waiting to be collected. There are different types of liquidity, e.g., trendline liquidity, buy-side liquidity, sell-side liquidity, double tops, and double bottoms, etc.

How Does The Smart Money Concept Trading Strategy Work?

The Smart Money Concepts, often abbreviated as SMC, owe their origins to The Inner Circle Trader (ICT), a program developed by Michael J. Huddleston. It was initially developed as a theory. But in the world of trading, theories turn into strategies. ICT’s teachings have been instrumental in popularizing SMC as a strategy among traders seeking a deeper understanding of market dynamics.

One of the intriguing aspects of SMC is its unique terminology. While SMC traders use terms like “liquidity grabs” and “mitigation blocks,” beneath the jargon lies a trading strategy grounded in classic price action concepts. It’s like learning a new language, but the underlying principles are more familiar than you might think.

Here are some key price action concepts that are used in SMC:

- Supply and Demand: At the heart of SMC lies the age-old concept of supply and demand. SMC traders are adept at identifying levels on price charts where significant buying or selling orders are concentrated. When prices approach these zones, it often results in a rapid price movement as market makers execute their orders.

- Price Patterns: Like traditional technical analysis, SMC traders look for chart patterns that explain future price movements. These patterns can include breakouts, reversals, and consolidations, all analyzed under the SMC framework.

- Support and Resistance: Support and resistance levels are vital in SMC trading. Traders identify key areas where prices tend to stall or reverse. In SMC terminology, these levels are sometimes called “mitigation blocks.” When prices reach these zones, SMC traders anticipate potential changes in market direction. However, unlike price action traders who use Fibonacci levels and supply and demand zones, SMC traders rely heavily on order block areas, break of structure, and Choch patterns.

The term “Smart Money” might sound mysterious, but it simply refers to institutional players and market makers with significant capital. Since they have the resources and they are standing close to the plate, these entities are concerned with profit and understand market dynamics more deeply than retail traders.

SMC traders aim to align their strategies with the intentions of smart money, often by tracking their movements through order blocks and breaker blocks.

Based on the SMC theory, financial markets are largely controlled by financial institutions, hedge funds, and governments. They significantly impact price movements in the market, and therefore, retail traders must be alert to their intentions to predict where the market is heading.

How to Trade with the Smart Money Concept Trading Strategy

There are different ways to trade the smart money concept strategy. While some professional traders may be obsessed with a complicated approach, here’s a more straightforward but effective way to trade SMC:

Step 1: Determine the Trend

The first thing you need to do when trading the SMC is to identify the primary trend. In SMC trading, determining the trend is based on a sound understanding of market structure. If this analysis is done correctly, we will often find trades on the right side of the market.

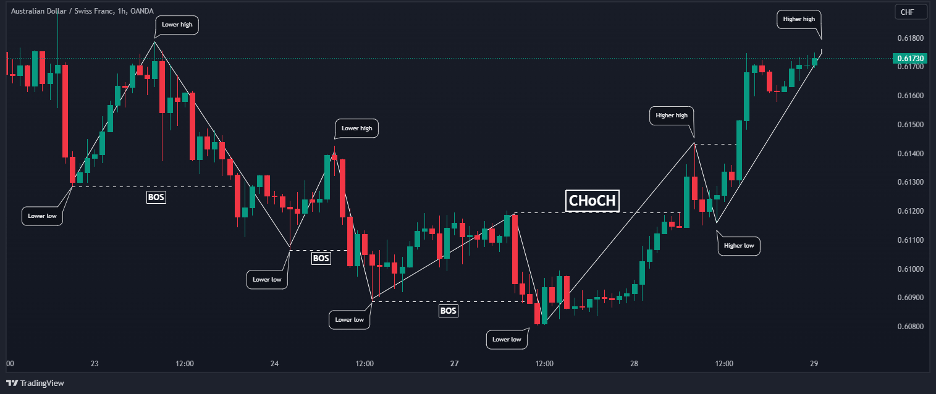

As we’ve mentioned, we are in a downtrend when the price breaks structure to the downside, forming a series of lower highs and lower lows. Conversely, a series of higher highs and higher lows signify an uptrend. Similarly, a change of character (Choch) signals the change of a trend.

The chart above shows that the trend has changed from bearish to bullish after the change of character. This means we are no longer looking to sell this pair. Instead, we want to buy when our entry criteria appear on the chart.

Step 2: Identify High Probability Order Block

After determining the trend, we are only concerned with identifying where the market makers are preparing to execute their orders and ride along, and this is where identifying the best order block is crucial.

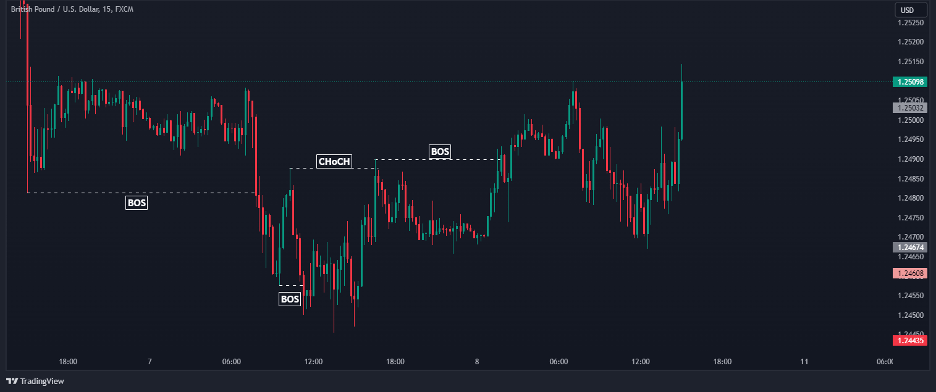

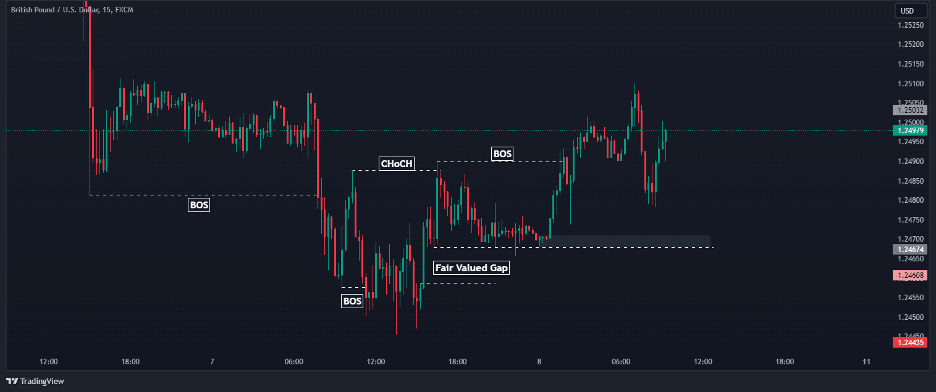

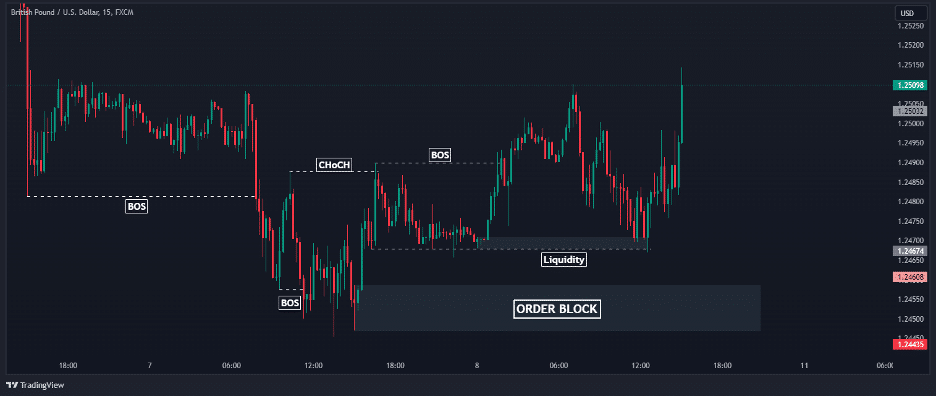

Usually, a high probability order block is one that either changes character or breaks market structure. It must also have liquidity above or below it or a fair value gap.

In our example, we can see a sell-side liquidity building under the first order block. Although it broke the market structure to the upside, there is also a fair valued gap directly under the supply and demand zone. We expect the market makers to take this liquidity out before continuing the uptrend.

The order zone below the liquidity is our high probability bullish order block for various reasons: it causes a CHoCH to the upside and has a liquidity and fair value gap just above it. We expect prices to come to this zone and continue the uptrend.

Step 3: Determine Your Entry and Exit Points

Next, you must identify areas where the big players enter the market. Identifying entry and exit points becomes easy after detecting a valuable supply or demand zone. For our illustration, we will place our entry just above the bullish order block while setting our stop loss just below the zone, and the target profit will be set to the structural high.

Smart Money Concept vs Price Action – What’s the Difference?

We have established that the smart money concept strategy is built on solid price action methodologies. Indeed, the smart money concept and price action trading have many similarities. Some might even claim that both are the same.

However, they are still different in the following ways:

Interpretation of Market Dynamics

The most important of all is how each method aims to interpret market dynamics. Price Action traders are primarily technical traders who seek to identify trends, reversals, and trading patterns that suggest potential price movements. They may not be as concerned with why these movements occur as long as they can make accurate predictions based on historical price data. They look at charts and rely on charts. Most of the time, they do not try to understand the reason why an asset moves in a particular direction.

SMC traders, on the other hand, are deeply interested in the underlying forces that drive price movements. They seek to understand the intentions of market makers and how supply and demand dynamics influence price. The core idea of the SMC theory is that instead of looking at the chart, SMC traders try to identify where the smart money goes. That’s the main goal of the SMC strategy – that is, to follow the money.