FOREX BANKs TRADING STRATEGY ( market makers method

Anyone successful in the forex market will hands down agree there is no greater career one could have. The ability to work your own schedule, the freedom, and income potential is hard to match with any other career. Having said that, what does it take to become successful in the forex market? Plain and simple we need the proper forex education to achieve success.

In a market with a success rate of 5% it is important that we search out and receive forex training that will allow us to be in that very small successful group of traders. How does one go about doing so? To put it simply if the forex trading strategy that is being used is one used by the masses, then how can one expect different results than the masses? 5% of retail traders succeed, which tells us that 95% fail and thus we have no other choice than to break free from the failing forex education system!

ENTER YOU ENEMIES HEAD AND THINK LIKE A BANK

Before we begin I would like to give a preface to the forex bank trading strategy. First, it is common knowledge that the banks drive the forex market. It is not a hidden fact that they drive the most amount of volume on a daily basis and as a result they drive short term moves. If we understand that the banks drive, manipulate, and push this market then wouldn’t it be hugely beneficial to track when they are entering and what position they are taking? This is the very foundation of the bank day trading strategy we employ. If we can decipher when they are entering, and what position they are taking then we do not need any further information to make a profitable forex trading decision.

We must remember that this is the banks market, and not ours! Retail traders are simply figurative flies on the wall. Keeping that in mind, why then do most retail forex traders out there attempt to invent or learn forex trading strategies that have been created to try and fit a market we do not control? It is our strong conviction at Day Trading Forex Live that success in the forex market is only possible when we stop trying to fit forex strategies to a market we don’t control, but rather learn the trading strategy of the banks! This is their business, and they have a business model (aka forex trading strategy) that we must learn to follow to achieve consistent results! Every day the banks repeat the same 3 step process. If we learn to trade forex by following their model we will have a much greater chance of success…after all the banks are the ones moving the market.

3 STEPS TO SUCCESS

As we just mentioned the banks use a 3 step process day after day to profit from the forex market. We can think of this process as their forex trading strategy. It has rules that they follow, it is repeatable, and it consistently results in profit. In any market there must be a counter party to every transaction. If you are looking to buy the market someone must be willing to sell to you, and conversely if you are looking to sell the market then someone needs to be willing to buy it from you. This is the basis for how the market at its foundation works and therefore this is how we track how the banks trade.

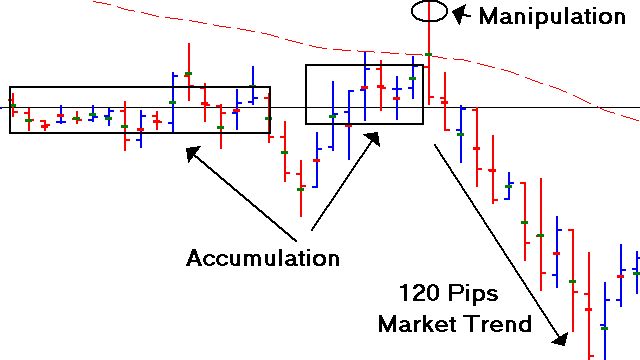

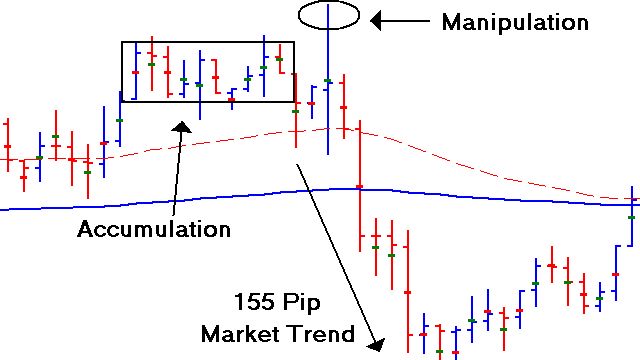

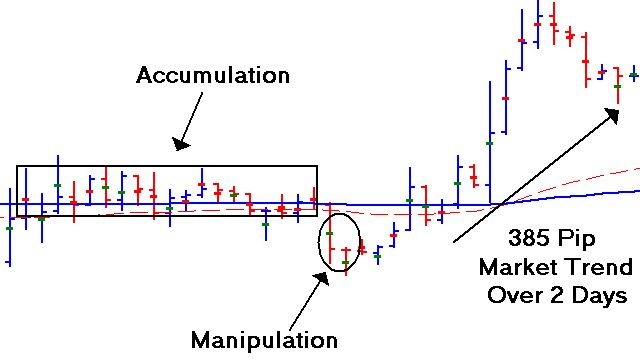

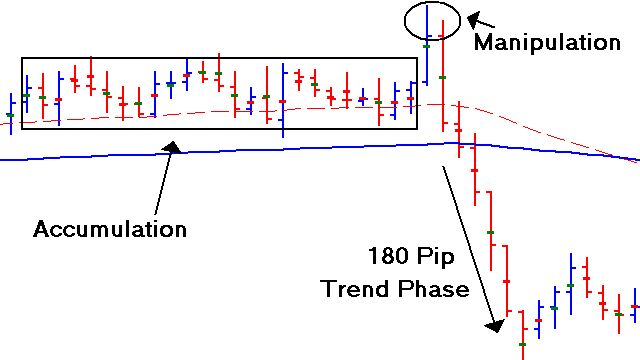

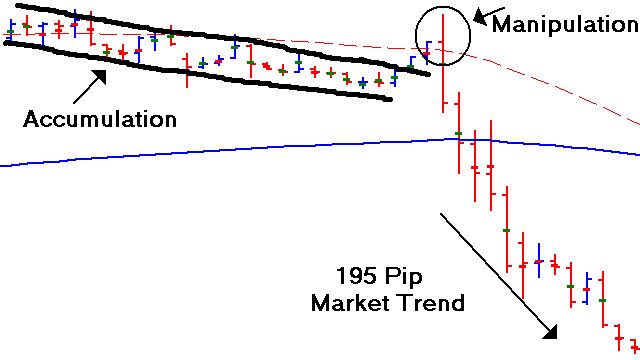

Accumulation: As discussed above there is a counter party to every transaction in any market including the forex market. Therefore when a bank or group of banks desires to enter the forex market they must do so by accumulating a position over time. Unlike you and I, because of the sheer volume banks push they must enter positions during times most people would term as consolidation or range bound markets.

These periods of consolidation are what we call accumulation as they are areas where smart money (banks, hedge funds, ect) enters or accumulates their desired position over the course of time. By doing this through tight range bound periods banks are able to not only keep what they are accumulating secret to the rest of the market, but they are also able to get a much better overall entry price. This is the foundation to any trade made by the banks. Money is made by accumulating a long position they will later sell off at a higher price, or accumulating a short position they will later cover at a lower price.

This is one of the most essential keys to trading forex successfully, and yet it is always over looked or worse yet called consolidation which is viewed as useless times in the market that mean nothing. Our single goal should be to track when the banks are entering the market and what position they are entering and thus these areas of accumulation are critical to our trading decisions. As discussed above banks are the ones moving this market, and therefore if you can identify the position they are accumulating you can identify which direction the market will move next with a high degree of accuracy. What then comes after this period of accumulation?

Manipulation: Over and over through my years of educating forex traders I’ve heard many forex traders say that it feels as if they are entering the market at exactly the wrong time. Many retail forex traders feel as if the market is just waiting for them to enter before it instantly turns the opposite direction. I’m here to tell you that it’s true! This is a critical idea that all must understand and come to accept. We all know the failure rate among traders, but what does this information tell us?

Remember above when we discussed that there must be a counter party to every trade? This is a well-known fact and it is indisputable. Because the mega banks position is so large they must essentially create their own market. For example lets say Bank X was looking to sell the EUR/USD. In order to sell the position size they desire there would have to be someone willing to buy an equal amount of the EUR/USD. This is where the retail forex trader comes in.

Forex traders are predictable. As a general rule of thumb all traders go through the same education, use the same trading strategies, and use the same software and indicators. While each strategy has its own small differences, the majority generate the same losing results and this is undeniable. If this weren’t true wouldn’t we see a success rate higher than 5%? Therefore while the strategies differ, the outcome and thus trades tend to be in large part the same which explains why the outcome of retail traders tends to be the same. Because of this the banks are well aware of how to get retail traders to enter the market.

Going back to our illustration if Bank X was looking to sell the EUR/USD then they would push the price up, which it turn would begin to trigger buying pressure from retail traders. At this same point they would begin to sell into all that buying pressure, and then the market instantly turns to the downside. This is the central reason many retail forex traders consistently enter the market at exactly the wrong time. The unfortunate part about this is the fact that this information is actually the most powerful thing the banks give us, but only if we open our eyes to it. The manipulation of price tells us what position they have been accumulating and thus tells us the direction they intend to drive the price. I urge you to look back at all large market moves. Before most every move in the forex market you will see a tight range bound period that is accumulation followed by a false push in the opposite direction of the trend.

Distribution/Market Trend: After they have accumulated a position through the standard tight ranging market, banks will often create a false push that we just discussed which is manipulation. This false push is an extension of the accumulation period as it allows them to finish entering the rest of the position they had been accumulating. This as we just discussed is the reason so many forex traders enter the market at exactly the wrong time. If however we know the tricks they use we can avoid being a pawn of the banks manipulation, and instead profit from it as they do!

If we have correctly identified which direction they have manipulated the market we can then understand which direction they intend to push the price. This is called the distribution phase of the market, and is seen visually as a market trend. Again this market trend comes only after the banks have finished accumulating their position through tight range bound price action as well as manipulation. Hands down this is the easiest area for us to profit from but only if we can properly identify the first 2 steps in the process. Through this article I have marked out this 3 step process on a series of charts. New concepts can be hard to understand with only words and therefore I believe the charts should serve you well in the learning process. As you examine these charts you should be identifying the 3 stages of the bank day trading strategy.

PUTTING FOREX IN PERSPECTIVE

Bottom line is this forex trading strategy is no doubt very different than what you have heard before. Realizing the chart is a false manipulation of prices and learning to read the intention behind the moves will take practice. Anything in life that is new takes time to learn and this will be no exception. However, the potential reward of being a profitable forex trader is massive and in our opinion unmatched! Having the freedom to do as you like, and the money to support that freedom is something forex trading offers to all of us, but only if we are willing to work for it. Everyone reading this knows most traders fail. Everyone reading this knows the general ways most trade. Therefore if you are using a forex trading strategy used by the masses I strongly urge you to give some serious thought as to why you feel the outcome will be different for you? At some point we all need to realize that maybe it’s not the tens of thousands of retail forex traders that are failing, but rather maybe it’s the strategies that are flawed to begin with. Therefore I again urge you to take in this free information, give it some thought, and apply it in your trading! I say this not to offend anyone but rather in a sincere effort to get everyone reading this thinking about the facts. Either way I sincerely wish you all the best and I truly hope I can serve you in your progression as a forex trader.